How to Make $1 Million in 10 Years or Less by Building an Online Business

One Million Dollars. It certainly has a nice ring to it, doesn’t it?

A lot of people in this world would love to call themselves millionaires one day, yet only a few will actually achieve it.

By acquiring a Net Worth of $1M or more, you will be well ranked in the top 1% of the world. You will also have definitely broken free from modern slavery.

The provocative guys over at the Wall Street Playboys website have done an excellent job outlining how anyone can achieve $1M of Net Worth in one decade. They laid out a strategic plan on how to do it and offered some other helpful insights too.

In this article, we will focus on how to do it by building an online business. I will present an action plan that will take you from $0 to $1M Net Worth in a decade or less.

Are you excited already? Let’s do it!

Want to get this article as a nice PDF ebook? Download it below!

What is our goal?

Before we start, we need to precisely define our goal. It has to be as specific and realistic as it can be.

First of all, we are not going to build the next Apple, because frankly the chances of one of us being the next Steve Jobs are rather slim. Also, we are not going to build a so called “unicorn” startup, i.e. one that has reached a valuation of $1 Billion (with a ‘B’) or more.

No. What we are going to do is build an online company that will provide you with the cashflow you need in order to reach $1M in liquid assets in a fairly short period of time.

Note that I am talking about liquid assets here. That means we will not include neither home equity nor business equity into our calculations (both have low liquidity in general).

We are talking about $1M in cold hard cash or cash equivalents.

Why $1,000,000?

So, why specifically $1M? First of all because it is a nice round number!

It is also the standard number to be used when we say that an individual is a millionaire. $1M is an important milestone in becoming rich.

Finally, and perhaps most importantly, by having $1M in cash, you are able to score a significant amount of passive income. Assuming a conservative 5% yield in financial investments, it means that you will receive $50,000 per year in “pure” passive income without even touching your original capital.

$50K per year, with a tax rate of maximum 20% (depending on your country), translates to around $3,333 per month. Money coming at you while doing nothing.

Having said that, we should also acknowledge the fact that $1M is not a lot of money, especially in this age of central banks money printing and inflation that erode your purchasing power.

The mindset behind this

In order to succeed in this exciting venture, you need to have the proper mindset.

An appropriate money mindset consists of many aspects, but fundamentally everything boils down to these simple equations:

Net Income = Income – Expenses

Accumulated Income → Wealth

The first one states that your Net Income is the (Gross) Income you earn minus your life Expenses, fairly simple.

In this equation, we must maximize the “Income” portion, and when I say maximize, I really mean it. We should achieve explosive income reaching 5 or even 6 figures per month. More on this later on. The “Expenses” part should be kept as low as possible without reaching frugality extremes though.

Ideally, your Income should grow on an exponential basis (we will see examples below), while your Expenses should grow only on a linear basis. This will allow you to save a massive amount of money each month.

During this journey, you should strive to save at least 80% of your income. This is of course only possible if you have a high monthly income and this is our major goal here.

Remember, the game of Wealth is won by playing both offence (high income) and defence (reasonable expenses), but mainly offence!

The second equation states that the income you accumulate every month via saving money will eventually translate into wealth. If you also invest that available income (we will discuss this later on too), you can expedite the process and reach your goal even faster.

The most critical element in this whole action plan is obtaining a high monthly income. We are going to achieve this by means of what MJ DeMarco calls “leveraged entrepreneurship”.

“Leveraged entrepreneurship” involves starting a business that can be scaled and can hit great levels of profitability.

Whether we like it or not, not all businesses can be scaled.

You will have to choose a type of business that has enough scale to reach the levels of income that will enable you to hit the million dollars mark as soon as possible. Otherwise, you will struggle with a venture of mediocre potential that will get you nowhere.

Let me say that again because it is crucial.

You need to choose a type of business that is scalable and saleable. If you plan to accumulate $1M by starting a local pizza joint, you are in for an uphill battle.

This is how the “online business” part comes into play. Your best bet in this journey is to start an online business.

Online businesses have major advantages over traditional brick and mortar ones.

Can’t offline businesses scale? Of course they can, and that is what several companies have been doing over the years. It just takes longer and it is much riskier, especially for newbie entrepreneurs.

Bottom line. Choose to go online. Don’t worry, after you are finished, the Internet is going to be your playground!

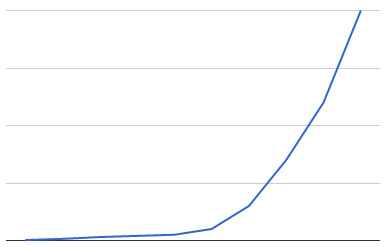

A final note in the mindset section is that you should be expecting results in an exponential form, not linear. Let me give you a “spoiler” of the next section.

Here is what you should expect your progress to look like:

What do you notice?

In the beginning your results will be feeble and mediocre. This is the main reason that people fail in this game. They start a venture and after a little while, they have zero to little results, so they get disappointed and quit.

But as you keep pushing forward, there is tipping point where things turn around and start trending higher. You need to hold on until that point is reached!

Quick QnA Session

Let’s also do a quick QnA session to get any recurring questions out of the way:

Will this be easy?

No. As anything worthwhile in life, this is going to be hard.

Are you sure? I have seen many “overnight successes” on TV. Won’t it be easy?

NO! There is no such thing as an “overnight success”. By the way, throw away your TV.

Will I need to read books?

Starting now, you will never stop reading.

What about entertainment?

Entertainment will be minimal along the way. Ditch your TV and prefer socialization with friends (ideally with the same mindset as you). A good idea is to watch series related to entrepreneurship, such as “Shark Tank” and “The Profit”.

Watching your Net Worth grow will be the best kind of entertainment you ever had.

Pre-Game

Before you embark on this quest, you will need to do some pre-game. You have to actively structure your environment in a way that maximizes your chances of success.

First of all, you need to establish some good health habits. This is going to be a long and rough journey, so you need to make sure your health is staying at optimal levels. Your body is going to get stressed with the long hours of working and sitting, so you must take the appropriate steps to protect it as well as possible.

Start with your nutrition. Get some education on what proper nutrition is. Cut the junk food and pile up on green vegetables. The 80/20 rule here is to eliminate anything that contains sugar or gluten from your diet.

Then comes working out. Physical exercise is crucially important to your health, well being and even productivity. Make sure to work out at least a little bit on a daily basis.

Finally, you will need to get several hours of quality sleep. In the beginning, you might not get so many hours of it, but you have to make sure those count. On the same note, you will have to plan for periods of recharging so that you keep your sanity.

The other major pillar of your pre-game is your productivity. Unfortunately, most people do not have a clue on how to work efficiently and productively.

You are going to work long hours and produce a huge amount of value, so this has to be done in the most efficient way possible. To achieve this, you need to follow a framework that will enable you to accomplish great results in minimal time.

If you stick to a properly set up daily ritual, you will notice over time that you will be able to accomplish more in one day than other people accomplish in one week. No joke.

Last but not least, you will have to properly build your social circle. This is usually one of the most difficult parts of the process, because emotions get in the way.

The short story is that you will need to minimize time around people that do not have the same mindset with you, and maximize time with peers who are on the same entrepreneurial journey. It is also very crucial to eliminate time around people that are negative and drag you down. You don’t need that kind of nonsense in your life.

The path to $1M – Timeline break down

Finally, it is time to talk money.

I will assume that you have zero net worth and zero technical skills, that you essentially start as an empty canvas. You will need to have an unlimited thirst for success though.

If you happen to have technical background in IT (computer engineer, software developer, etc.), that is great! This knowledge and familiarity with machines will save you a lot of time and money, especially in the early stages. A warning though. You will need to focus all your subsequent reading on marketing (digital for the biggest part), sales, soft skills and all those aspects that usually IT people are not good at.

This whole plan will take almost a decade, so let’s talk a bit about ages.

Ideally you should start at your early twenties, so by the time you are thirty you will be a millionaire. Realistically though, people are not very mature and self-disciplined in such a young age, so let’s assume that you start out at 25.

That means that you will have made it until you get 35, an age where you will still be vibrant and energetic (especially if you follow my advice on taking care of your nutrition and physical exercise).

Ready? Here is your path to glory.

(Note: At the end of each year I will be posting your expected after-tax yearly Income and accumulated Net Worth.)

Year 1

Starting out, you know nothing about how to make money online or build a business. You also don’t possess any particularly valuable skill. Additionally, you start with $0 in the bank.

Your first year is focused on acquiring knowledge. You are expected to read at least 25 books during that period. The books should be around money, entrepreneurship, business, sales, marketing etc. You should also read books on human nature and soft skills. These will give you some clarity on how human beings really work.

“Formal education will make you a living; self-education will make you a fortune.”

– Jim Rohn

On the money front, you have no other choice but to get a job. In general, having a job sucks. But now you strategically decide to take one, so that you can cover your expenses and focus on one thing: self-education.

Since you have no skills, you will probably end up in the lower range of the compensation spectrum. After accumulating a little sum as a financial buffer (emergency fund), plow the rest of it in your education. Attend courses, seminars and everything in between.

Around mid-year, after having read about 10-15 books you will begin to recognize patterns and see how irrationally people behave when it comes to money. Now you know better.

At the same time, you are reading articles on entrepreneurship and especially online businesses, non-stop.

Now, beware! Don’t read the click-baiting crap that is published on mega-sites like Entrepreneur.com, Inc.com and BusinessInsider.com.

The majority of the articles there are shallow, abstract, non-applicable and/or non-actionable. Waste of time. Reading those will get you infected with “Entrepreneurial Fuckarounditis”, a dangerous disease that affects entrepreneurs over the world.

Are there useful pieces that you could read on those sites? Absolutely. Unfortunately, they are lost in a sea of worthless pseudo-articles.

Instead, go to the following websites, find their archives and start devouring them from their beginning:

- Forever Jobless

- Okdork

- Viper Chill

- Entrepreneurs Journey

- Charles NGO

- Wall Street Playboys

- Bold and Determined

By the end of the year, you will have a decent theoretical understanding of how the Internet works and how you can make money on it. You will also start leaning towards a specific type of venture, e.g. based on Internet Marketing, Affiliate Marketing, SaaS etc.

Income: $15,000 – Net Worth: $2,000

Year 2

Starting your second year, it is time to ditch your unskilled position for something related to the Internet industry. Since you have a fair amount of knowledge on the subject, you find a low entry position on a company that is doing online business.

You are now busting your ass to do the best job possible, but most importantly to learn. You are moving from a theoretical knowledge, to understanding how things work in the real world. You spot the A-players of the company (statistically around 5% of the employees there) and study their work process and way of thinking.

On the self-education part, you are switching your focus to the most technical stuff. You scale down to 1 book per month, but you gear up on technical studying. You add all the authority sites into your RSS reader and follow the latest developments in the industry.

Mid-year, some first thoughts about starting your own business come to mind, but you kill them because you lack both technical and business expertise. Good choice. Patience is a virtue.

Money wise, you receive a slightly better compensation, but of course nothing special. You accumulate a small amount of money which will be used as capital for your venture in the future.

Income: $20,000 – Net Worth: $10,000

Year 3

The first two years you followed the plan to the letter, but things have been fuzzy. You are not quite sure what you are doing. This is the year where you finally get some clarity on your path.

You remain in the company you were working and continue to build your skills and network with the most valuable employees there, as well those of the competition. Since you are an A-Player (top 5%), you get a bump in your salary and the boss wants you to work for him forever.

On the self-education part, you are switching gears again. You reduce your technical reading and now focus on acquiring business skills. Marketing, sales, copywriting, accounting, everything is fair game. You observe how things operate within the company you work from a business perspective, and it is clear to you what is functioning properly and what is not.

Mid-year, you have several ideas for projects that you could build a business around. You know that it is critical to start a project that will scale sufficiently, so you weed out any ideas that do not have enough scale.

You keep only a handful of them and for each one, you perform some quick tests in order to validate it and assess whether there is a need in the marketplace. For those that seem viable, you perform extreme due diligence. You study the niche, the competition and how you can fit in the market.

You find the one venture with the biggest potential and you are now ready for the next step.

Income: $25,000 – Net Worth: $15,000

Year 4

This is the year where you launch your business on the side. You are not looking to raise capital from outside investors, you are bootstrapping this baby. You use the savings you have amassed over the previous years to get things started and keep all the equity for yourself.

You continue to work as an employee, but you are not consuming all your energy on your day job. You save it and pour it as sweat equity in your own venture.

“Sweat equity is the most valuable equity there is. Know your business and industry better than anyone else in the world. Love what you do or don’t do it.”

– Mark Cuban

However, you are working so efficiently and productively, that you can still differentiate yourself from the masses in the office and be considered an A-player.

The side business seems to have potential. Of course at the beginning nobody knows who you are, so it is difficult to get sales and revenue. You know that building a solid business takes time and effort, so you persevere.

You allocate most of your free time on your side business and focus on marketing and spreading the word.

After 6-9 months of launching, you begin to see a small trickle of revenue. Remember, this is going to be exponential. At the beginning the results will be feeble.

You now have two distinct sources of income, but the overall income increase is minimal. Same thing with your net worth, since you are investing some money in the business.

Income: $30,000 – Net Worth: $20,000

Year 5

This is the year when you lay the ground to leave your day job. It has served you well over the years, but you have outgrown it.

By now you have a better understanding of the industry your business operates in and you know where you should focus. You are building the business on a solid foundation. Quality is your top priority.

The business brings in some decent revenue but nothing to write home about. You still work as a madman in your free time. This is going to be huge!

You still have two sources of income, but it is clear that your side business will soon start to generate more income than your day job.

Income: $60,000 – Net Worth: $25,000

Year 6

The time has come. It is now painfully obvious that you are leaving money on the table by not working full time on your business. You strategize your exit.

You assess that your business is solid and it is not going to crumble if the market conditions deteriorate. You also have built a healthy amount of savings that you can fall back to, in case everything fails.

Mid-year you quit your day job on the best terms possible, never leave with anger.

You are your own master now.

Being your own boss is tricky. With no one over your shoulder, you might get complacent. You need self-discipline to make yourself work the long hours needed. But you do it, because you have a goal to accomplish.

Your overall income increases but you are still in the small leagues. Time to gear up.

Income: $120,000 – Net Worth: $50,000

Year 7

This is the year you put in the effort to really scale the business. You have been growing it for over 3 years and now it starts to get some real traction. I have empirically noticed that most businesses and ventures break out around 3-4 years after they launch.

You have full awareness of the industry landscape so you make strategic moves that will capture even more market share in the near future. You also put in place the processes that will allow you to automate the business almost fully so that you soon remove yourself from the equation.

Every day that passes you know that you made the right choice to leave your job and venture on your own. You also confirm that an online business is the way to go nowadays, this is the optimal vehicle to building wealth.

Your income goes significantly up, you are now “walking” on the exponential part of the curve.

Income: $200,000 – Net Worth: $150,000

Year 8

Scale is finally kicking in after the massive effort of the previous year.

You notice that your business is attaining some really impressive growth rates. A good metric to keep in mind is that at the early stages, you company should be growing at a 100% rate year on year, i.e. doubling its revenue every year.

One more year of massive growth and you win the game.

Income: $300,000 – Net Worth: $350,000

Year 9

You are almost there. The business is firing on all cylinders. You have automated or delegated everything and you are only in charge of the strategic overview.

Your baby has grown. You remember the early years and are surprised to see how things have evolved. It was an awesome journey.

You start thinking about your next moves.

Income: $380,000 – Net Worth: $600,000

Year 10

You are finally there. Your business is a major player in the space and it is churning out money. It is bringing in $500K in after tax earnings.

You have multiple options here:

- You can sell the business for a lofty valuation. With its earnings potential and growth profile, it could easily sell for over $2M.

- You can hire a CEO to run the business and just enjoy the dividends rolling at your bank account.

- You can be more aggressive and run it yourself for another 5 years to make it a beast.

All valid approaches, it will depend on your personality and life situation.

As the year ends, you reminisce your journey. Well, after all, this was a piece of cake. Why don’t more people do it?

Income: $500,000 – Net Worth: $1,000,000

“There’s no such thing as an accidental entrepreneur – it’s deliberate, it’s conscious, and it’s hard work.”

– Richard Branson

That’s it. A 10-year plan to hit the elusive $1M target.

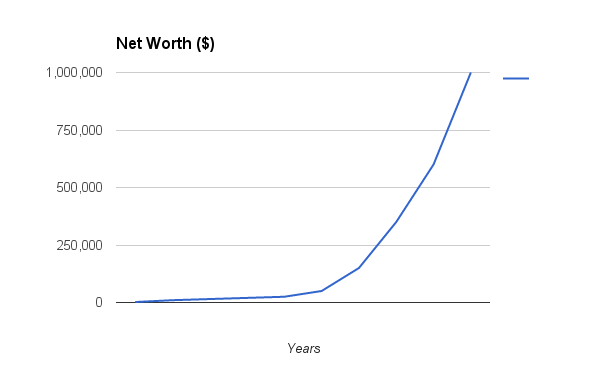

After discussing the timeline in detail, let’s see what the yearly numbers look like in order to get a more helpful overview.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Income | 15,000 | 20,000 | 25,000 | 30,000 | 60,000 | 120,000 | 200,000 | 300,000 | 380,000 | 500,000 |

| N/W | 2,000 | 10,000 | 15,000 | 20,000 | 25,000 | 50,000 | 150,000 | 350,000 | 600,000 | 1,000,000 |

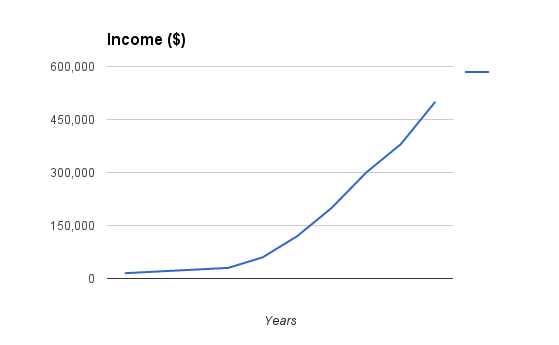

Let’s also have a visual representation:

You can see the characteristic exponential curve we have been talking about. Notice that in the case of the Net Worth figures, it is even steeper. That is why you have to be consistent. The real results start coming in after 5 years or more into the game.

The fine details

With this action plan, you can hit the $1M goal within a decade or less. It will take huge effort and self-discipline, but it is attainable. If you are smart and have self-control, you can do it much faster.

Let’s add some clarifications.

Do I need a partner on this?

I would say YES. If you can find a person you trust and who has the same mindset and aspirations with you, then venture with him. Things are going to be tough in the beginning, so having someone along on the journey can be a morale booster.

In that case of course, you will have to adjust the numbers for the income that the business has to bring in. For example, on Year 10, it should be bring in around $1M. Keep in mind that being two of you, there will be double the labor you can provide and double the brain capacity you may use, so the company should grow larger.

$500K a year? That is too big!

Actually it is not. It is on the most conservative side of the spectrum.

People that are working as employees have a linear money mindset so they can’t understand how this can be achieved.

“If I am making $50K a year, and I get a 5% raise per year, I will need a bazillion years to reach $500K. This is fake!”

Likewise, people that are working as freelancers might also find this unrealistic.

“If I am charging $100 per hour, I am going to need to work 5000 hours this year, or over 13 hours of work per day, every day of the year. This can’t be done!”

That is why you need to leverage a business entity, where you will not be a bottleneck.

A company that runs for over 6 years should easily clear over $500K per year, otherwise there is something fundamentally wrong with it. Again, the prerequisite is to have started a business with sufficient scale. I cannot stress this enough.

No way! $500K a year is unrealistic

OK. Let’s see how this can be achieved. I am going to analyze the case of monetizing a web property (a website for example), since this is my preferred cup of tea and area of expertise.

First some accounting math.

In order to get $500K in after-tax earnings, your company has to make around $833K in pre-tax earnings, assuming an overall 40% tax rate. Sorry, but government has to take its cut too.

Now, assuming a 80% Net Margin (easily attained for an online company which monetizes web properties), you will need a Revenue of around $1M. This seems insurmountable, but wait.

It is true that $1M per year seems to far fetched. For this reason we will break it down to a monthly amount. Monthly, your business should be making around $83K in revenue.

In a recent case study, Internet Marketing expert Neil Patel writes:

“In most consumer niches, you need to generate roughly 1,000,000 to 1,500,000 visitors a month to start seeing numbers like $100,000 a month in income. This is at least what I’ve seen by working with dozens of blogs in the consumer niche over the years.”

Of course you and I are not Neil Patel, so let’s take the worst case scenario, 1.5M visitors per month. But we need $83K, not $100K, so our visitor count should be around 1.3M.

Do you think that after building a website for over 7 years in a sufficiently large industry, you won’t be able to attract 1.3M visitors per month? It should be fairly easy, unless you have been fumbling around all this time.

By the way, Neil Patel is trying to achieve the $100,000 monthly revenue target within 1 year.

In all cases, you have to be a force of nature. Your competitors should look at your year on year growth with awe. “How did they manage to scale like that?”. $1M per year is not unrealistic.

Turbo-charge your results

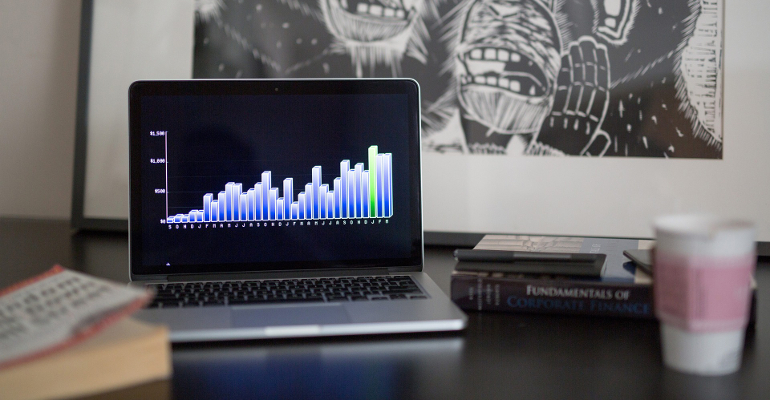

There is a secret ingredient that you could add in the mix in order to turbo-charge your results and reach your target faster: Investing in the stock market.

Stocks investing might seem scary to a lot of people especially after the Internet bubble of the early 2000s and the more recent stock market crash triggered by the financial crisis of 2007.

However, investing in the stock market can expedite your wealth building process assuming you follow some simple rules. Let’s see how you can do it.

Before your 5th year on this plan, you should not even think about investing. First of all, you have too little capital. Next, any existing capital should be deployed to building your own business. And finally, your thoughts should revolve around how to grow your business. Just forget about investing.

After the 5th or 6th year however, you start getting some real cash. As we have said, you do not spend that money, you are saving like there is no tomorrow.

Some of the proceeds should definitely be reinvested in your own company to spur growth. However, after a while it is possible that money cannot be allocated efficiently within the business. It is time to crank out some dividends to the shareholders (yourself and other founders if they exist).

The money you get out of the company (consult your accountant on how to properly do that) can be invested in the stock market. Now, there is a tons of material and advice on the subject, but you should not care about most of it.

We will follow the greatest investor’s advice:

“It is not necessary to do extraordinary things to get extraordinary results. […] By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals.”

– Warren Buffett

The process should be as follows:

- Spend 15-20 hours max studying the fundamentals of stocks and investing

- Find a low-cost index fund which acts as market proxy

- Invest money in the index every single month without thinking it

- You never sell any of the position, just keep adding

- You reinvest the dividends to take advantage of the compounding force

The end.

When it comes to investing, you should be unemotional as a robot. Whatever the market conditions, you just keep adding every month like clockwork. You automate the process so that you do not have to manually do it. Then you get busy building your business and getting some capital to deploy in the index fund.

This process will help you amass your target Net Worth much faster and also protect your savings against the force of inflation. Excellent.

Conclusion

Building $1M in Net Worth is not difficult assuming you have a solid game plan to achieve it.

In this article, I laid out a plan on how to raise that amount of money over the period of 10 years by leveraging an online business.

Here are the main points:

- Take care of your health habits, productivity workflow and environment

- Spend your first 1-3 years on self-education and becoming one of the best in the industry

- Work in a related company and get to know the industry from the inside

- Launch an online business that has the potential to scale into large numbers

- Work on your business furiously to transform it into a beast

- Save aggressively and invest unemotionally your money surplus to boost results

- When you hit your Net Worth target, choose your next step wisely

You have the blueprint. Now, go out and start your own journey. Talk to you again in 10 years.

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

– Bill Gates

No Responses